by Spencer Fernando

SpencerFernanado.com

August 7, 2017

History shows that excessive debt is dangerous and always exacts a high price. Yet, those in power are acting as if there’s no problem at all.

A recent article on Zero Hedge discussing rising debt levels has a big warning for Canada.

The article focuses on the immense amount of debt in China, and the possibility that the bubble is close to bursting. However, the article goes beyond China, pointing out how the Canada and Australia are facing giant debt levels – and are deeply tied to the danger in China as well.

As the article notes:

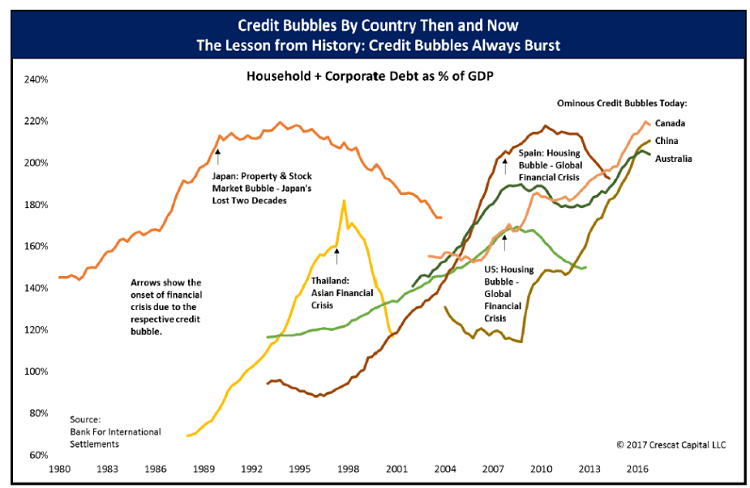

“The Bank for International Settlements (BIS) has identified an important warning signal to identify credit bubbles that are poised to trigger a banking crisis across different countries: Unsustainable credit growth relative to gross domestic product (GDP) in the household and (non-financial) corporate sector. Three large (G-20) countries are flashing warning signals today for impending banking crises based on such imbalances: China, Canada, and Australia.”

The following chart was also included, and the comparison between Canada’s debt levels and historical pre-crisis peaks are disturbing:

Read More HERE